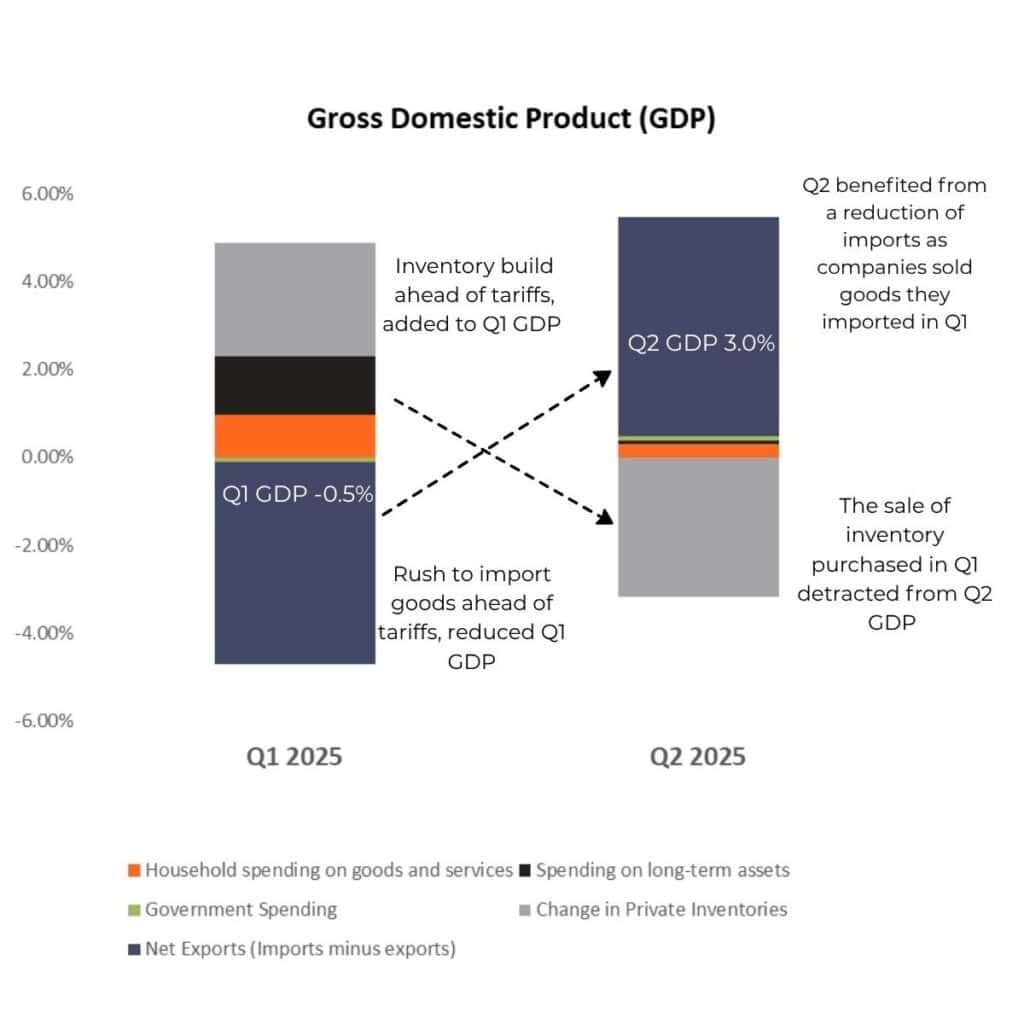

GDP for Q2 2025 rose 3.0%, beating consensus, but the one quarter gain only tells part of the story.

The main driver was a significant swing in trade:

- Imports collapsed by 30.3% annualized in Q2, reversing Q1’s 37.9% surge caused by pre-tariff demand. This boosted GDP growth by approximately 5 percentage points.

- Inventories sharply reversed from a positive contribution in Q1 to a substantial decline in Q2, subtracting 3.2 percentage points from GDP in the second quarter.

Excluding these volatile components, real final sales to private domestic purchasers, a measure of how much individuals and businesses within the U.S. are actually buying excluding, imports, exports, and inventory, rose just 1.2%, down from 1.9% in Q1. This metric is important because it strips away short-term fluctuations from trade and inventory swings, providing a clearer view of the underlying domestic demand.

Bottom line: Underlying growth is steady but moderating. Volatile swings in imports, exports, and inventories distort the headline figure, masking a more muted economic reality.

*Source is Bureau of Economic Analysis

Disclosure

This material is provided by Gryphon Financial Partners, LLC (“Gryphon”) for informational purposes only. It is not intended to serve as a substitute for personalized investment advice or as a recommendation or solicitation of any particular security, strategy or investment product. Facts presented have been obtained from sources believed to be reliable. Gryphon, however, cannot guarantee the accuracy or completeness of such information. Gryphon does not provide tax, accounting or legal advice, and nothing contained in these materials should be taken as tax, accounting or legal advice. Individuals should seek such advice based on their own particular circumstances from a qualified tax, accounting or legal advisor.