OVERVIEW

EQUITIES

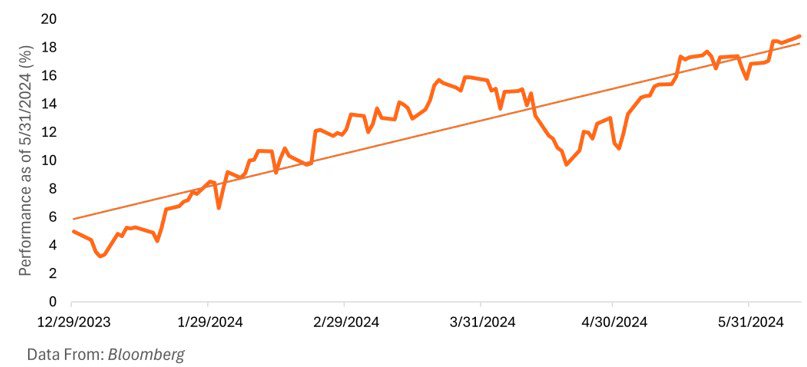

Equities have embarked on a robust journey since the beginning of the year, with the S&P 500 surging by an impressive 12.99%. Delving deeper into the benchmark (S&P 500) and dissecting it across various sectors, it’s evident that certain sectors are spearheading this surge. Communication Services (+21.53%), Information Technology (+18.36%), and Utilities (+13.59%) are notably driving the index’s upward trajectory.

S&P 500 Index Performance

Information Technology, commanding the largest weight at 31.29%, has been particularly noteworthy due to the significant buzz surrounding AI. With leading technology firms worldwide unveiling their own iterations of AI, its expansion is poised to persist throughout 2024 and into 2025. Notably, Nvidia, the world’s largest chip manufacturer, crossed the monumental $3 trillion market cap threshold on June 5th, joining the elite ranks of Apple and Microsoft in this exclusive club.

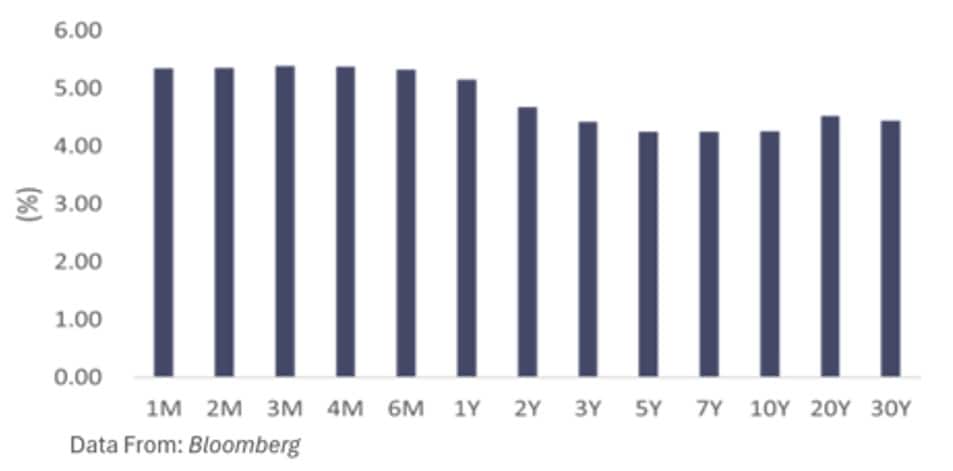

BONDS

The US Core bond market is currently characterized by low valuations, offering a moment to re-evaluate exposure to municipal, corporate, or government bonds. Following a rebound from their decline in April, bonds are demonstrating resilience. Notably, short-term bonds are outperforming their longer-term counterparts (1 year+).

US T-Bond Yields

With the Federal Reserve scaling back its rate hikes, bond prices have started to experience a gradual ascent. Market sentiment indicates an adjustment from the six anticipated rate cuts in 2023 to the current pricing of two rate cuts. The Federal Reserve is anticipated to maintain rates within the range of 5.25% to 5.5% for the foreseeable future. Forecasters are projecting a hiatus in rate cuts until the fall of this year, attributed to persistent inflationary pressures. September is projected to be the absolute earliest that the Fed will begin to cut rates.

MACRO REVIEW

FOREIGN ECONOMIES

International markets are trailing behind their US counterparts, evidenced by the MSCI EAFE Index returning 5.94% compared to the robust 12.99% returned by the S&P 500 as of 5/31/2024. Notably, Ireland’s market has emerged as a strong performer, marking the highest globally by 4.77% (as of 5/31/2024). However, economic indicators present a mixed picture. Japan’s GDP growth in Q1 fell short of expectations, registering a rate of 2%, while China surpassed forecasts with a Q1 GDP growth rate of 5.3%, aligning closely with the Chinese government’s growth target of 5.0%. Geopolitical tensions, notably in the Middle East and Ukraine, loom as significant factors impacting global markets. Moreover, recent leadership changes in Mexico and India, coupled with the impending U.S. election in November, are poised to exert further influence on world markets in the near future. In contrary, conflicts in the middle east typically raise oil prices, but that is not the case this time around.

UNEMPLOYMENT

Unemployment has consistently remained below the 25-year average, signaling a robust economy. As of May 2024, the unemployment rate stands at approximately 4%, notably lower than the historical average of 5.7% since 1948. This sustained level reflects the current strength of the U.S. job market, with demand for workers persistently outpacing supply since the pandemic.

INFLATION

The U.S dollar declined in value vs. most major currencies and the price of oil had its worst month in 2024 so far. The current inflation rate (Core CPI) is 3.3%, 80 basis points higher than the 25-year average. Consumer spending has taken a dip since March, along with consumer sentiment. Personal savings have also dipped below the pre-pandemic savings rate. Wage growth is continuing to decline as well. In 2023 there was a steady decline in inflation, but progress has slowed lately as shelter costs are slow to adjust to market rental rates.

DISCLOSURES

Sources: Asset Consulting Group, Bloomberg and S&P 500. All returns as of 5/31/2024, if not otherwise cited. This material is provided by Gryphon Financial Partners, LLC (“Gryphon”) for informational purposes only. It is not intended to serve as a substitute for personalized investment advice or as a recommendation or solicitation of any particular security, strategy or investment product. Facts presented have been obtained from sources believed to be reliable. Gryphon, however, cannot guarantee the accuracy or completeness of such information. Gryphon does not provide tax, accounting or legal advice, and nothing contained in these materials should be taken as tax, accounting or legal advice. Individuals should seek such advice based on their own particular circumstances from a qualified tax, accounting or legal advisor.