Overview

- 24-hour news cycles, the advent of the internet, and online trading have increased the ability of investors to react quickly

- Volatility is ever-present in markets, but the long-term investor is often rewarded for looking past the headlines of the day

- For the long-term investor, short-term volatility offers opportunities to enhance portfolio outcomes

No Shortage of Recent Headlines

Post Global Financial Crisis, capital markets experienced a prolonged period of historically low interest rates, low inflation, and muted volatility. Over the past two years we have written about numerous events that have been the source of near constant headlines and increased market volatility: COVID, Russia’s war with Ukraine, a global spike in inflation, deglobalization, mid-term elections, elevated US debt levels, an inverted Treasury yield curve, China reopening, and the instability of the US banking system.

Despite these many events, most of which are ongoing, implied market volatility has reverted towards long-term historical norms, as measured by the VIX index (equities) and MOVE index (bonds).

Volatility as an Opportunity

After a decade of relative underperformance, developed non-US markets have done well to start 2023, but mega-cap technology stocks have rallied around “AI” to lead global equity markets higher following a difficult 2022. Fixed income assets are also generally recovering from 2022 declines. Year-to-date through July 31st, a 60/40 mix of MSCI ACWI (+18.11%) and the Bloomberg US Agg (+2.02%) has returned 11.67%.

It is easy to immediately react to the news cycle of the day. However, investors are often rewarded by avoiding reactionary decisions and adhering to strategic asset allocations. Volatility is an ever-present and necessary function of capital markets and diversification. For the long-term investor, ignoring the negative headlines of the day can lead to enhanced outcomes.

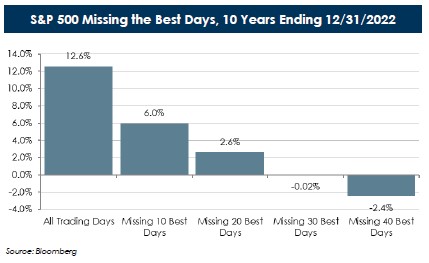

For equity investors, there is value in remaining invested over time despite increasingly loud headline noise. Missing the ten best S&P 500 trading days in the decade ending in 2022 cuts the annualized return of the index by more than half. Historically, many of the best trading days occur within the same periods as the worst days. Over the last ten years (~2,500 trading days), the three best and five worst days for the S&P 500 all occurred within a 28-day period from March 9 to April 6, 2020. On March 16, when the index was down 12% on the day, few might have guessed from their quarantine location that the S&P 500 would be up 9.4%on March 24, just eight days later, enroute to an 18% total return for 2020.

Within US equity, diversification through a style-neutral approach to portfolio construction has been beneficial in reducing volatility in recent years. For example, in 2021 US Large Cap Growth “LCG” beat US Large Cap Value “LCV” by 2%, then in 2022 LCG lost to LCV by 22%, and 2023 YTD LCG is beating LCV by 22%.

Traditional fixed income managers are often afforded flexibility to allocate across an assortment of debt instruments (US Treasuries, corporate bonds, mortgage-backed securities, etc.). With this variety, usually there is at least one asset that offers some level of protection to the investor. In 2022, the Bloomberg US Aggregate bond index incurred the worst loss in its history of -13%. While no meaningful subsector of the index was positive last year, tactical portfolio rotations by Unconstrained managers such as avoiding long duration US Treasury bonds (-29.3%) in favor of 1-3-year maturity corporate bonds (-3.3%) benefitted relative performance and helped moderate losses.

Regardless of asset class, volatility creates opportunity for the various allocations within a diversified portfolio to work in tandem over the course of a market cycle.

Our Position

In today’s market environment, having a long-term view, remaining diversified, and avoiding quick reactions to the news of the day reinforces the benefits of and continued commitment to a long-term strategic allocation. We continue to believe in the benefits of a globally diversified equity portfolio. Diversified portfolios across regions, sectors, industries, market capitalizations, and styles are better suited to navigate spikes in short-run volatility and enhance long-term results. Similarly, we continue to believe fixed income portfolios can benefit long-term from incorporating complementary flexible mandates allowing managers to take advantage of short-term dislocations across the full opportunity set of the asset class.

Disclosures

The views expressed herein are those of Asset Consulting Group (ACG). They are subject to change at any time. These views do not necessarily reflect the opinions of any other firm. This report was prepared by ACG for you at your request. Although the information presented herein has been obtained from and is based upon sources ACG believes to be reliable, no representation or warranty, express or implied, is made as to the accuracy or completeness of that information. Accordingly, ACG does not itself endorse or guarantee, and does not itself assume liability whatsoever for, the accuracy or reliability of any third party data or the financial information contained herein.

Certain information herein constitutes forward-looking statements, which can be identified by the use of terms such as “may”, “will”, “expect”, “anticipate”, “project”, “estimate”, or any variations thereof. As a result of various uncertainties and actual events, including those discussed herein, actual results or performance of a particular investment strategy may differ materially from those reflected or contemplated in such forward-looking statements. As a result, you should not rely on such forward-looking statements in making investment decisions. ACG has no duty to update or amend such forward-looking statements.

The information presented herein is for informational purposes only and is not intended as an offer to sell or the solicitation of an offer to purchase a security. Please be aware that there are inherent limitations to all financial models, including Monte Carlo Simulations. Monte Carlo Simulations are a tool used to analyze a range of possible outcomes and assist in making educated asset allocation decisions. Monte Carlo Simulations cannot predict the future or eliminate investment risk. The output of the Monte Carlo Simulation is based on ACG’s capital market assumptions that are derived from proprietary models based upon well-recognized financial principles and reasonable estimates about relevant future market conditions. Capital market assumptions based on other models or different estimates may yield different results. ACG expressly disclaims any responsibility for (i) the accuracy of the simulated probability distributions or the assumptions used in deriving the probability distributions, (ii) any errors or omissions in computing or disseminating the probability distributions and (iii) and any reliance on or uses to which the probability distributions are put.

The projections or other information generated by ACG regarding the likelihood of various investment outcomes are hypothetical in nature, do not reflect actual investment results and are not guarantees of future results. Judgments and approximations are a necessary and integral part of constructing projected returns. Any estimate of what could have been an investment strategy’s performance is likely to differ from what the strategy would actually have yielded had it been in existence during the relevant period. The source and use of data and the arithmetic operations used for calculating projected returns may be incorrect, inappropriate, flawed or otherwise deficient.

Past performance is not indicative of future results. Given the inherent volatility of the securities markets, you should not assume that your investments will experience returns comparable to those shown in the analysis contained in this report. For example, market and economic conditions may change in the future producing materially different results than those shown included in the analysis contained in this report. Any comparison to an index is for comparative purposes only. An investment cannot be made directly into an index. Indices are unmanaged and do not reflect the deduction of advisory fees.

This report is distributed with the understanding that it is not rendering accounting, legal or tax advice. Please consult your legal or tax advisor concerning such matters. No assurance can be given that the investment objectives described herein will be achieved and investment results may vary substantially on a quarterly, annual or other periodic basis. There is no representation or warranty as to the current accuracy of, nor liability for, decisions based on such information.

Gryphon Financial Partners shall not in any way be liable for claims and make no expressed or implied representations or warranties as to their accuracy or completeness or for statements or errors contained in or omissions from them. This was created for informational purposes only. Gryphon Financial Partners, LLC is an Investment Adviser.