Please find the next blog in our monthly series that provides a snapshot of the markets and the state of the economy.

Economic Overview

- Risk assets declined in September as investors reacted to weaker economic data, the debt ceiling fight, and shifting policy support

- Fed messaging tilted more hawkish, with tapering likely later this year and increased support for a 2022 rate liftoff

- Inflation moderated but is expected to remain elevated into 2022 amid ongoing supply disruptions and labor shortages

Market Returns

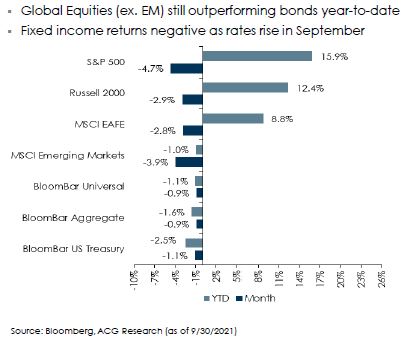

- Global Equities (ex. EM) still outperforming bonds year-to-date

- Fixed income returns negative as rates rise in September

Asset Class Valuation

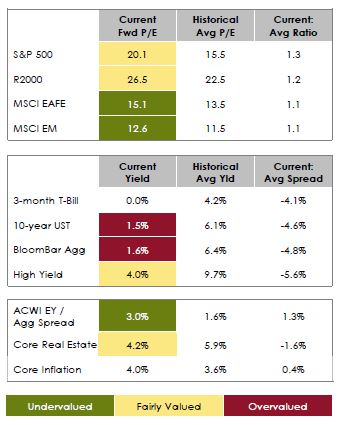

- Equities still favored over bonds

- Non-US equities favored over US equities

- Equities, H.Y. bonds, R.E. provide an inflation hedge

Key Risks We Are Watching

- Coronavirus Delta Variant

- Fiscal Stimulus

- Consumer Behavior – Savings/Spending

- Financial Conditions; Fed Tapering

- Regulatory Policy Shifts (US and China in particular)

Disclaimers:

The views expressed herein are those of Asset Consulting Group (ACG). They are subject to change at any time. This report was prepared by ACG for you at your request. Although the information presented herein has been obtained from and is based upon sources ACG believes to be reliable, no representation or warranty, express or implied, is made as to the accuracy or completeness of that information. Accordingly, ACG does not itself endorse or guarantee, and does not itself assume liability whatsoever for, the accuracy or reliability of any third party data or the financial information contained herein. Certain information herein constitutes forward-looking statements, which can be identified by the use of terms such as “may”, “will”, “expect”, “anticipate”, “project”, “estimate”, or any variations thereof. As a result of various uncertainties and actual events, including those discussed herein, actual results or performance of a particular investment strategy may differ materially from those reflected or contemplated in such forward-looking statements. As a result, you should not rely on such forward-looking statements in making investment decisions. ACG has no duty to update or amend such forward-looking statements. The information presented herein is for informational purposes only and is not intended as an offer to sell or the solicitation of an offer to purchase a security.

Please be aware that there are inherent limitations to all financial models, including Monte Carlo Simulations. Monte Carlo Simulations are a tool used to analyze a range of possible outcomes and assist in making educated asset allocation decisions. Monte Carlo Simulations cannot predict the future or eliminate investment risk. The output of the Monte Carlo Simulation is based on ACG’s capital market assumptions that are derived from proprietary models based upon well-recognized financial principles and reasonable estimates about relevant future market conditions. Capital market assumptions based on other models or different estimates may yield different results. ACG expressly disclaims any responsibility for (i) the accuracy of the simulated probability distributions or the assumptions used in deriving the probability distributions, (ii) any errors or omissions in computing or disseminating the probability distributions and (iii) and any reliance on or uses to which the probability distributions are put. The projections or other information generated by ACG regarding the likelihood of various investment outcomes are hypothetical in nature, do not reflect actual investment results and are not guarantees of future results. Judgments and approximations are a necessary and integral part of constructing projected returns. Any estimate of what could have been an investment strategy’s performance is likely to differ from what the strategy would actually have yielded had it been in existence during the relevant period. The source and use of data and the arithmetic operations used for calculating projected returns may be incorrect, inappropriate, flawed or otherwise deficient.

Past performance is not indicative of future results. Given the inherent volatility of the securities markets, you should not assume that your investments will experience returns comparable to those shown in the analysis contained in this report. For example, market and economic conditions may change in the future producing materially different results than those shown included in the analysis contained in this report. Any comparison to an index is for comparative purposes only. An investment cannot be made directly into an index. Indices are unmanaged and do not reflect the deduction of advisory fees. This report is distributed with the understanding that it is not rendering accounting, legal or tax advice. Please consult your legal or tax advisor concerning such matters. No assurance can be given that the investment objectives described herein will be achieved and investment results may vary substantially on a quarterly, annual or other periodic basis. There is no representation or warranty as to the current accuracy of, nor liability for, decisions based on such information.

Gryphon Financial Partners shall not in any way be liable for claims and make no expressed or implied representations or warranties as to their accuracy or completeness or for statements or errors contained in or omissions from them. This was created for informational purposes only. Gryphon Financial Partners, LLC is an Investment Adviser.