At the beginning of November, the IRS announced its new updated limits for retirement savings.

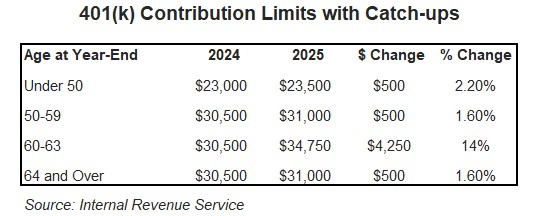

- Starting in 2025, employees can contribute $23,500 to their 401(k) plans, up $500 from 2024.

- Catch up contributions for those ages 50-59 will remain at $7,500.

- Also starting in 2025, employees aged 60, 61, 62, and 63 will have a super-size catch up contribution of $11,250 on top of the $23,500 deferral limit meaning these employees can defer a total of $34,750 which is about 14% higher than 2024.

- Catch up contributions for those ages 64 and over will remain at $7,500.

- Unlike the 401(k) adjustments, the contribution limit for individual retirement accounts (IRAs) and Roth IRAs will remain the same in 2025 at $7,000 with a $1,000 catch up for those 50 and older.

Disclosures:

This material is provided by Gryphon Financial Partners, LLC (“Gryphon”) for informational purposes only. It is not intended to serve as a substitute for personalized investment advice or as a recommendation or solicitation of any particular security, strategy or investment product. Facts presented have been obtained from sources believed to be reliable. Gryphon, however, cannot guarantee the accuracy or completeness of such information. Gryphon does not provide tax, accounting or legal advice, and nothing contained in these materials should be taken as tax, accounting or legal advice. Individuals should seek such advice based on their own particular circumstances from a qualified tax, accounting or legal advisor.