Tariffs are taxes on imports calculated as a percentage of a product’s value. When imposed, tariffs can increase the cost of imported goods, which might contribute to inflation. However, several other factors can mitigate this effect.

Currency Movements

When one country imposes tariffs on another, demand for the targeted country’s currency typically falls. Consequently, the imposing country’s currency may strengthen, enhancing its purchasing power and partially offsetting higher import costs.

Reciprocal Tariffs

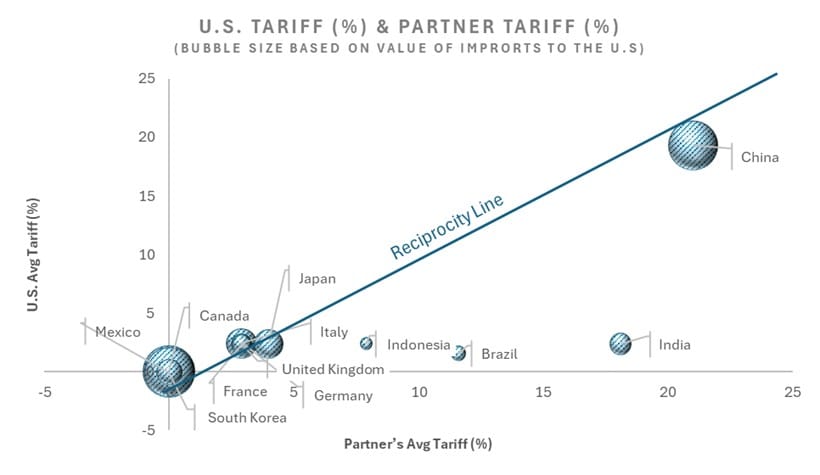

The current administration plans include pursuing reciprocal tariffs—imposing duties equal to those other countries levy on their exports. This strategy aims to balance trade relationships, although it can also escalate tensions. The goal of reciprocal tariffs is to encourage other countries to lower their tariffs but there is no guarantee of success.

The tariff imbalance was greatly reduced in 2018-2019. Today, the Tariff imbalance among the United States and its largest trading partners are already near reciprocity. While smaller trading partners such as Indonesia, Brazil and India maintain a large imbalance.

*Source: Gryphon Financial Partners, Bloomberg, World Trade Organization (WTO), U.S Trade Representative (USTR) and World Bank

Retaliation and Demand Reduction

Affected countries often retaliate with their own tariffs, reducing overall trade. This decline in economic activity can lessen demand-driven price increases. In fact, Federal Reserve research suggests that such retaliatory measures may dampen inflation by slowing economic growth.

Monetary Policy vs. Trade Policy

Milton Friedman once said, “Inflation is always and everywhere a monetary phenomenon.” While not entirely accurate, this highlights the significant role of monetary policy. If tariffs push prices higher, the Federal Reserve might raise interest rates, which typically strengthens the U.S. dollar and further counteracts inflation. Adjustments in fiscal policy, such as government spending and tax changes, can also help mitigate inflationary pressures.

Historical Perspectives

- 1930 – The Smoot-Hawley Tariff Act: This act raised tariffs to high levels during the Great Depression. Global partners retaliated, and trade fell by an additional 66%, leading to severe deflation.

- 2018–2019 – U.S.–China Trade War: Despite tariffs on hundreds of billions of dollars of Chinese goods (an estimated overall rate of 4%), a 14% depreciation of the Renminbi largely neutralized the impact, resulting in minimal inflation.

Key Takeaway

While tariffs increase the cost of imported goods, real-world factors such as currency shifts, retaliatory measures, and monetary policy adjustments often offset their inflationary impact. Ultimately, reduced overall trade and an appreciating dollar can have broader implications—potentially affecting corporate earnings and emerging market financing—beyond just inflation.

Investors should watch for potential deflation caused by a reduction in overall trade and excessive dollar appreciation. An appreciating dollar puts pressure on S&P 500 company earnings and leads to distress in funding markets for emerging-market businesses and governments. To date, the trade weighted dollar, as measured by the Federal Reserve, has appreciated 6% from its pre-election low. While a headwind to markets, this is within the range of normal market volatility.

Disclaimer

This material is provided by Gryphon Financial Partners, LLC (“Gryphon”) for informational purposes only. It is not intended to serve as a substitute for personalized investment advice or as a recommendation or solicitation of any particular security, strategy or investment product. Facts presented have been obtained from sources believed to be reliable. Gryphon, however, cannot guarantee the accuracy or completeness of such information. Gryphon does not provide tax, accounting or legal advice, and nothing contained in these materials should be taken as tax, accounting or legal advice. Individuals should seek such advice based on their own particular circumstances from a qualified tax, accounting or legal advisor.