Overview

- In just a few decades time, China has achieved its longstanding goal of becoming the “world’s factory”

- China’s low labor costs and rapid development of supply chain infrastructure were key drivers in this transformation

- Government policy and rising geopolitical tensions pose potential headwinds to China’s manufacturing dominance

How Did China Become So Dominant?

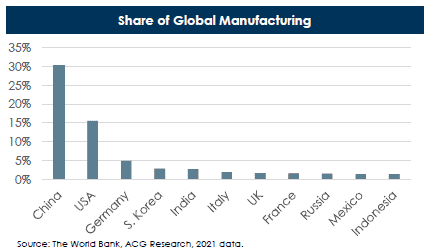

Just-in-time manufacturing was originally developed in Japan to minimize manufacturing costs by ordering components to arrive just before assembly, thereby reducing the need for inventory and warehouse space. China incorporated just-in-time practices into its rapid industrial transformation, quickly becoming the manufacturing hub for the world. As many corporations across the globe looked for ways to reduce costs and increase profits, China positioned itself as the “world’s factory,” offering a large, skilled workforce with significantly lower labor costs. A broadly less stringent regulatory environment provided further cost benefits and efficiencies to multinational companies. Recent World Bank data shows the magnitude of China’s manufacturing dominance.

What Changed?

For many companies around the world, the practice of manufacturing in China and exporting the goods to their final destinations worked very well until recently. The COVID pandemic exposed the risks of concentrating manufacturing in one country. China’s Zero COVID policy essentially locked down entire cities/regions within China, which shut down production of many goods and disrupted supply chains as transportation logistics were negatively impacted. The pandemic disruptions, combined with elevated geopolitical tensions, including issues of national security and protection of intellectual property rights, has resulted in many companies reassessing their global manufacturing and supply chain management. Most recently, the war in Ukraine has highlighted a similar concentration risk with respect to commodities, as much of Europe’s energy supply has traditionally been sourced from Russia. In the latter half of 2022, countries dependent on Russian energy had the unenviable task of trying to diversify their energy supply before the onset of winter.

Potential Beneficiaries

For any given country, the ability to onshore their Chinese manufacturing operations will depend on multiple factors, including domestic manufacturing infrastructure, labor force skill level and cost structure, and the regulatory environment. Other factors include tariff structures, tax incentives, and trade pacts/treaties between countries. Many of these same factors also apply to offshoring outside of China, increasing the appeal of countries such as India, Mexico, and Vietnam.

A recent example of onshoring includes Intel, which is considering relocating portions of its production to the US, citing potential US government regulations. Several large multinational companies have announced potential changes to their offshore manufacturing capabilities. Nike is looking to increase manufacturing in Southeast Asia, citing potential quality improvements and cost savings. Microsoft is considering Europe as a manufacturing option to reduce supply chain risks, and HP is looking to Mexico to improve efficiencies and reduce costs.

Unintended Consequences?

Diversifying production away from a single country brings additional concerns that must be factored into the production decision. Labor costs are not static and can change over time, language and cultural barriers can be more significant, currency risk increases, and sourcing qualified workers can prove challenging. Politically, China is a significant trade partner with other Southeast Asia countries, and that fact could be used to dissuade these countries from taking on the production previously based in China. Tariffs and trade policies could be altered to impact companies who move portions of their manufacturing from China. This could result in fragmented production (where the same product is made in multiple countries), which could increase manufacturing costs and reduce efficiency.

Investment Implications

Changing global manufacturing networks will take time, and companies will need to balance expected benefits with potential trade-offs. As manufacturing networks evolve, there could be positive and negative implications, favoring the use of active managers who can analyze the various outcomes and adjust exposures as appropriate. With respect to overall portfolio construction, we believe the best approach is to maintain long-term, globally diversified investment portfolios designed to weather any short-term negative volatility, while positioned to participate in longer-term positive trends.

Disclosures

The views expressed herein are those of Asset Consulting Group (ACG). They are subject to change at any time. These views do not necessarily reflect the opinions of any other firm.

This report was prepared by ACG for you at your request. Although the information presented herein has been obtained from and is based upon sources ACG believes to be reliable, no representation or warranty, express or implied, is made as to the accuracy or completeness of that information. Accordingly, ACG does not itself endorse or guarantee, and does not itself assume liability whatsoever for, the accuracy or reliability of any third party data or the financial information contained herein.

Certain information herein constitutes forward-looking statements, which can be identified by the use of terms such as “may”, “will”, “expect”, “anticipate”, “project”, “estimate”, or any variations thereof. As a result of various uncertainties and actual events, including those discussed herein, actual results or performance of a particular investment strategy may differ materially from those reflected or contemplated in such forward-looking statements. As a result, you should not rely on such forward-looking statements in making investment decisions. ACG has no duty to update or amend such forward-looking statements.

The information presented herein is for informational purposes only and is not intended as an offer to sell or the solicitation of an offer to purchase a security. Please be aware that there are inherent limitations to all financial models, including Monte Carlo Simulations. Monte Carlo Simulations are a tool used to analyze a range of possible outcomes and assist in making educated asset allocation decisions. Monte Carlo Simulations cannot predict the future or eliminate investment risk. The output of the Monte Carlo Simulation is based on ACG’s capital market assumptions that are derived from proprietary models based upon well-recognized financial principles and reasonable estimates about relevant future market conditions. Capital market assumptions based on other models or different estimates may yield different results. ACG expressly disclaims any responsibility for (i) the accuracy of the simulated probability distributions or the assumptions used in deriving the probability distributions, (ii) any errors or omissions in computing or disseminating the probability distributions and (iii) and any reliance on or uses to which the probability distributions are put.

The projections or other information generated by ACG regarding the likelihood of various investment outcomes are hypothetical in nature, do not reflect actual investment results and are not guarantees of future results. Judgments and approximations are a necessary and integral part of constructing projected returns. Any estimate of what could have been an investment strategy’s performance is likely to differ from what the strategy would actually have yielded had it been in existence during the relevant period. The source and use of data and the arithmetic operations used for calculating projected returns may be incorrect, inappropriate, flawed or otherwise deficient.

Past performance is not indicative of future results. Given the inherent volatility of the securities markets, you should not assume that your investments will experience returns comparable to those shown in the analysis contained in this report. For example, market and economic conditions may change in the future producing materially different results than those shown included in the analysis contained in this report. Any comparison to an index is for comparative purposes only. An investment cannot be made directly into an index. Indices are unmanaged and do not reflect the deduction of advisory fees.

This report is distributed with the understanding that it is not rendering accounting, legal or tax advice. Please consult your legal or tax advisor concerning such matters. No assurance can be given that the investment objectives described herein will be achieved and investment results may vary substantially on a quarterly, annual or other periodic basis. There is no representation or warranty as to the current accuracy of, nor liability for, decisions based on such information.

Gryphon Financial Partners shall not in any way be liable for claims and make no expressed or implied representations or warranties as to their accuracy or completeness or for statements or errors contained in or omissions from them. This was created for informational purposes only. Gryphon Financial Partners, LLC is an Investment Adviser.