Overview

- Innovation and technological advancements have fueled economic growth, shaping our modern world

- AI is not a new concept, but recent innovations could have lasting impacts

- Disruptive technologies have historically created new opportunities along with winners and losers

Impact of Innovation

Throughout history, technological advances have played a pivotal role in fueling economic growth and shaping societies alike. From the earliest inventions, such as the ladder, to the cutting-edge digital technologies of present day, each leap forward has unleashed a wave of transformational power on economies worldwide. Artificial Intelligence (AI) is the latest innovation that could reshape our daily lives.

Historical Technological Advances and Economic Impact

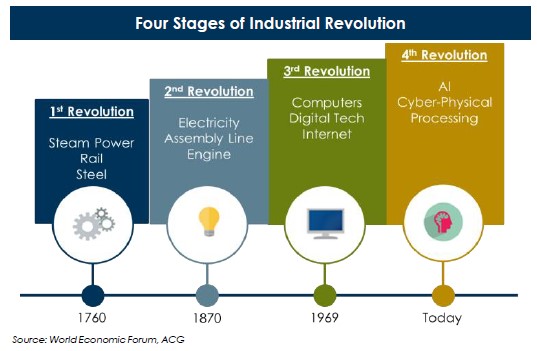

AI is being considered “The Fourth Industrial Revolution.” So, it is only fitting to look at past industrial revolutions as an indicator for the future. The first Industrial Revolution had impacts that unfolded over decades as steam power adoption and the maturing of newly created industries took time. This progress led to the second industrial revolution in the late 19th century, featuring advancements like electricity, assembly line production, and transportation improvements. This era facilitated global connectivity and laid the foundation for the third industrial revolution, the Digital Revolution, characterized by computers, digital technologies, and the internet. Similarly, AI could represent a transformative force that empowers automation and creates efficiencies in a manner reminiscent of past technological revolutions.

Artificial Intelligence Evolution

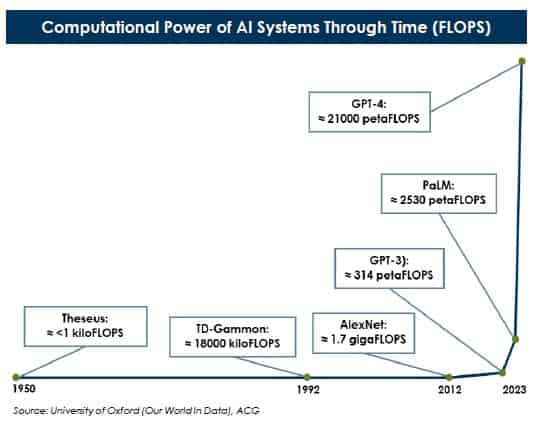

AI began its journey in the 1950s with Theseus, a small robotic mouse that could solve and remember mazes, hinting at the potential for machines to learn. In the 1960s, neural networks emerged mimicking human brain processes, and later, the rise of the internet provided AI systems enough input to learn and adapt. However, the recent evolution in AI has been due to advancements in computational power. Floating Point Operations per Second (FLOPS) is a key metric to measure how fast a computer can perform calculations. For reference, the first AI programs had computing power measured in kiloFLOPS (1000 FLOPS). Today, we have reached the era of petaFLOPS (1 quadrillion FLOPS) and beyond. To help comprehend that level of computational power, it would take about 31.7 million years for someone to count from one to one quadrillion.

Risks and Concerns with Artificial Intelligence

One critical concern in today’s context is the concept of “technological unemployment,” a term coined by economist John Maynard Keynes, which refers to the potential for mass unemployment as technological advancements improve productivity, reducing the need for human labor. Additional issues include bias and fairness, data transparency, and concerns over dependence and control. Mitigating these risks will play an important role in the success of AI going forward.

Winners and Losers of Innovation

With every technological advancement, new industries are born and businesses will seek to exploit untapped market potential. Yet, as competition intensifies, only a select few will rise as industry leaders, while the majority may falter. Take, for instance, the early internet era where the need to navigate the vast online landscape led to the beginning of search engines. Although numerous companies sprung up, only a few like Google and Bing achieved success. The same may hold true for AI. The AI landscape is diverse and rapidly changing. Companies currently reaping the benefits are those engaged in developing large language models, providing cloud storage, and supplying the hardware to power AI. While this is likely the initial stage, the future of AI remains uncertain. Just like past industrial revolutions, it will take time for AI to integrate into society and for its economic impact to be observable.

Our Position

While it is tempting to invest in headline-grabbing thematic ideas, it is important to understand the inherent risks of concentrating portfolios in themes that are likely to evolve and shift over time. We believe maintaining a diversified portfolio can help mitigate risks while providing exposure to a range of thematic trends, including AI.

Disclosures

The views expressed herein are those of Asset Consulting Group (ACG). They are subject to change at any time. These views do not necessarily reflect the opinions of any other firm. This report was prepared by ACG for you at your request. Although the information presented herein has been obtained from and is based upon sources ACG believes to be reliable, no representation or warranty, express or implied, is made as to the accuracy or completeness of that information. Accordingly, ACG does not itself endorse or guarantee, and does not itself assume liability whatsoever for, the accuracy or reliability of any third party data or the financial information contained herein.

Certain information herein constitutes forward-looking statements, which can be identified by the use of terms such as “may”, “will”, “expect”, “anticipate”, “project”, “estimate”, or any variations thereof. As a result of various uncertainties and actual events, including those discussed herein, actual results or performance of a particular investment strategy may differ materially from those reflected or contemplated in such forward-looking statements. As a result, you should not rely on such forward-looking statements in making investment decisions. ACG has no duty to update or amend such forward-looking statements.

The information presented herein is for informational purposes only and is not intended as an offer to sell or the solicitation of an offer to purchase a security. Please be aware that there are inherent limitations to all financial models, including Monte Carlo Simulations. Monte Carlo Simulations are a tool used to analyze a range of possible outcomes and assist in making educated asset allocation decisions. Monte Carlo Simulations cannot predict the future or eliminate investment risk. The output of the Monte Carlo Simulation is based on ACG’s capital market assumptions that are derived from proprietary models based upon well-recognized financial principles and reasonable estimates about relevant future market conditions. Capital market assumptions based on other models or different estimates may yield different results. ACG expressly disclaims any responsibility for (i) the accuracy of the simulated probability distributions or the assumptions used in deriving the probability distributions, (ii) any errors or omissions in computing or disseminating the probability distributions and (iii) and any reliance on or uses to which the probability distributions are put.

The projections or other information generated by ACG regarding the likelihood of various investment outcomes are hypothetical in nature, do not reflect actual investment results and are not guarantees of future results. Judgments and approximations are a necessary and integral part of constructing projected returns. Any estimate of what could have been an investment strategy’s performance is likely to differ from what the strategy would actually have yielded had it been in existence during the relevant period. The source and use of data and the arithmetic operations used for calculating projected returns may be incorrect, inappropriate, flawed or otherwise deficient.

Past performance is not indicative of future results. Given the inherent volatility of the securities markets, you should not assume that your investments will experience returns comparable to those shown in the analysis contained in this report. For example, market and economic conditions may change in the future producing materially different results than those shown included in the analysis contained in this report. Any comparison to an index is for comparative purposes only. An investment cannot be made directly into an index. Indices are unmanaged and do not reflect the deduction of advisory fees.

This report is distributed with the understanding that it is not rendering accounting, legal or tax advice. Please consult your legal or tax advisor concerning such matters. No assurance can be given that the investment objectives described herein will be achieved and investment results may vary substantially on a quarterly, annual or other periodic basis. There is no representation or warranty as to the current accuracy of, nor liability for, decisions based on such information.

Gryphon Financial Partners shall not in any way be liable for claims and make no expressed or implied representations or warranties as to their accuracy or completeness or for statements or errors contained in or omissions from them. This was created for informational purposes only. Gryphon Financial Partners, LLC is an Investment Adviser.